Leadership for a sustainable governance

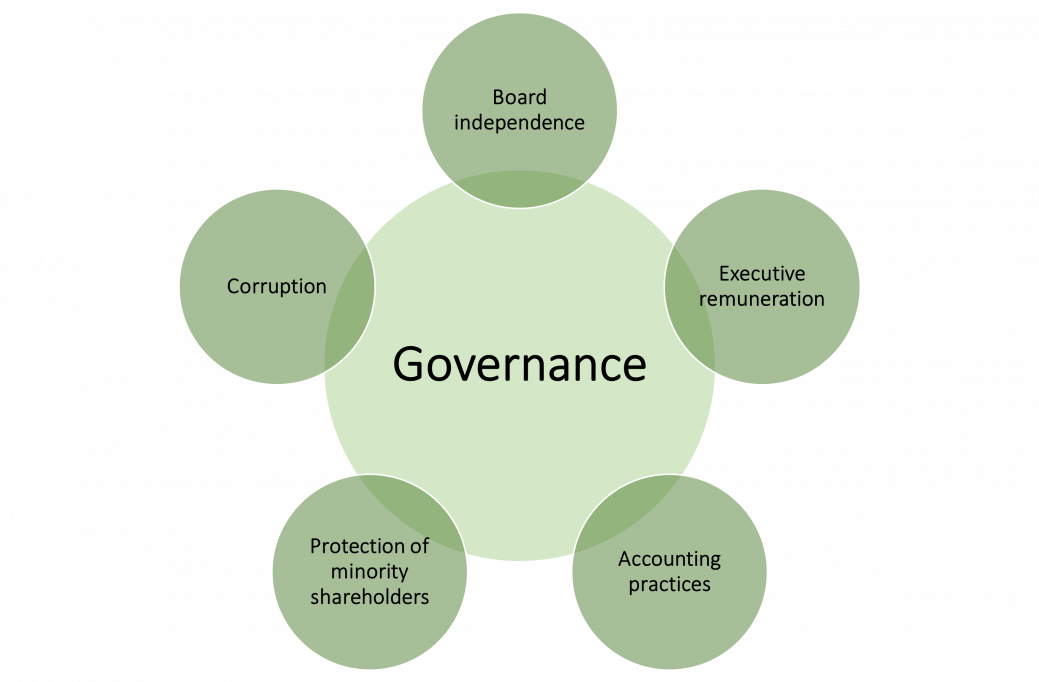

Governance, which focuses on transparency and integrity, encompasses varied aspects, from corporate board and management structures to a company's internal systems, policies, standards, etc. to operate and ensure compliance. Concerning the topics covered by the “G”, not intending to be an extensive list, here are some of them:

Why is the “G” important for businesses?

Sustainable governance should be considered as a pre-requisite for a company to achieve its ESG objectives and ambitions. In this sense, ineffective corporate governance can lead to an infringement of the undertaking's environmental and social objectives, commitments and guiding principles. Therefore, robust sustainable governance factors must be a core component of the ESG strategy and agenda.

Designing and implementing a solid sustainable governance brings along many benefits for companies. Advantages such as reinforcing the business strategy by incorporating sustainability at its heart, ensuring overall accountability, effectively managing processes and systems, as well as strengthening relationships with internal and external stakeholders.

With the objective to build a successful and sustainable governance, companies need to measure their management and ethics-related practices, leadership style and other governance structures and initiatives they implement.

Some governance KPIs that businesses can use are the following:

- Ethics, integrity and responsibility:

- Creation of and commitment to a Code of Conduct.

- Ethics program and reporting mechanisms for ethics infringements.

- Anti-corruption and anti-bribery:

- Number of managers and employees that have received anti-corruption and anti-bribery training.

- Number of incidents related to corruption / bribery per year and derived actions.

- Initiatives and measures to prevent corruption and bribery.

- Executive remuneration: the disclosure of executives' salaries and bonus payments enhances transparency and allows the verification of adequate remuneration to employees.

- Accounting practices: having clearly defined accounting practices and policies is essential to measure environmental, social and economic performance and progress.

The “G” as a core value in Mazars in Denmark: the partners' perspective.

We are delighted to announce that two of our colleagues have been appointed as partners at Mazars in Denmark. Marie Gunni Bergh and Dennis Herholdt Rasmussen have just joined Pia Lillebæk and Kurt Christensen. The four of them will continue working to maintain and enhance the sustainable governance that started when Mazars in Denmark was established in 2007.

Read the next lines to get to know their vision about sustainable governance and its implementation in our business.

Pia Lillebæk – Managing partner

In your opinion, what are the key governance principles to build a sustainable business?

I consider several governance principles as fundamental to build and ensure a sustainable governance:

- Integrity and ethics: partners and members of the board need to know the business and the regulation, as well as act as a role model for both internal and external stakeholders to be able to have a positive impact. Moreover, we must be a step ahead to adjust to the new regulations and legal frameworks, but also to the constant changes in the business landscape. As public trustees, we need to go beyond regulation in terms of ethics and integrity.

- Diversity: we represent a board ready for the future. A diverse board (gender, geographies, background, age...) where all our employees and clients can see themselves reflected; a board where different perspectives are listened to and taken into consideration.

- Bias: it is essential to have discussions about bias and to be aware that everyone is privileged blind, so continuous training in terms of bias is key to build a sustainable business.

Why is internal and external stakeholder engagement important in terms of sustainable corporate governance?

Regarding internal stakeholders, it is extremely relevant to obtain their input and their feedback to ensure alignment and awareness, as well as to improve the company´s results, since their opinions help guide the efforts towards enhancing the company´s strategy.

External stakeholders´ engagement, especially clients´ and regulatory institutions´, is also fundamental. In this sense, good communication is vital. For instance, through client surveys, we gather feedback that is valuable for us and gives us the opportunity to react if necessary (we contact the clients to understand the situation and solve a possible misunderstanding).

Concerning regulatory institutions, such as the audit oversight bodies, they engage with companies and test their audit system, which is essential to ensure and demonstrate that we understand and comply with the regulation, as well as perform our work in the correct way.

All in all, stakeholder engagement ensures quality and positively affect sustainable corporate governance.

Kurt Christensen – Partner

Why is it essential for companies to have adequate anti-corruption and anti-bribery policies / mechanisms in place?

Among most Western countries, there is an expanding focus on anti-corruption and anti-bribery policies. This comes mainly from both regulators and increasingly from significant market players, including large companies, financial institutions and other financial players.

Having those policies in place is therefore necessary partly to comply with applicable legislation and regulation. Moreover, the complexity and requirements can only be expected to increase in the coming years, which means that companies must have systems that allow them to act according to the regulatory requirements.

In addition, there is a growing expectation in the market for businesses to establish and comply with anti-corruption and anti-bribery policies. Thus, it may be necessary to obtain sources of funding, enter into cooperation agreements and act as suppliers for other companies that demand and publish such policies.

Furthermore, there is an augmenting demand and focus on sound corporate governance in several areas among end users.

Consequently, having an open and honest position and communication will be a necessity and can lead to increased earnings over time.

What is the role you consider that ethics and integrity play in governance in the audit business?

Ethics and integrity are essential for running an audit firm. As the public’s watchdog (in Denmark, the offentlighedens tillidsrepræsentant) stands as guarantor of compliance, it is crucial to maintain a high and undisputed ethical level, as well as an elevated level of integrity. This applies to all aspects of running an audit firm, involves all employees, and includes aspects that go beyond the professional performance during the working hours. If the auditor's ethics and integrity are questionable, the business foundation and the trust in the company disappear.

Dennis Herholdt Rasmussen – Partner

What initiatives can be implemented in terms of corporate governance to ensure that Mazars in Denmark will continue having a sustainable business in the long run?

In my view, there are varied initiatives that can be carried out for that purpose:

- Sharing knowledge on the current and future trends to enhance the focus on sustainability.

- Mapping out the current business footprint to understand the present status and use it as a starting point to set new and future goals. These will point to where our sustainable business should go and will help to establish the necessary measures to achieve them.

- Dividing the goals into separate timelines (short, medium and long term) and different areas will make it easier to manage the progress and have a continued evolution.

- Using corporate sustainability indicators for measurement facilitates process tracking as these will be the starting anchor points for the initial status.

With sustainability in mind, in what way do you think that the leadership style, and yours in particular, affects the employees and the governance?

I don't consider there is a “one-fits-all solution”. However, I believe that being genuine in your actions shows a truthful style. As a leader, you set an example; however, if your example is not honest and doesn´t truly reflect the person you are, the result is not positive. Therefore, it is important that leaders take the first steps because they want to and they think it is the correct thing to do.

I prefer the subtle effect of a genuine willingness to make an effort. If it is sincere, people will be interested and will collaborate. If it is truthful, it will be noticed.

People are unique, so the way in which a leadership style will impact them will be different.

Marie Gunni Bergh – Partner

What kind of leadership style is implemented at Mazars in Denmark? How do you consider this affects sustainable governance?

I think our leadership style characterises for being flexible and open-minded. This requires a high dose of accountability from everyone, as we all need to be aligned in terms of quality, regulations, etc. We all need to share a common framework.

We place great importance in our values. As an example, I can mention that integrity is a fundamental value for us; we are aligned on a global scale to ensure that we always do what we say we do. Ownership, participation and collaboration are other key pillars: it is important that employees play a role, are listened to and feel free to always share ideas that we can discuss, regardless of the outcome and final possibilities of implementation.

Our leadership style affects sustainable governance, since opening our minds and fostering the values mentioned before makes possible for everyone to impact the company. We have a purpose, seize opportunities, are open and consider and welcome new ideas to improve.

In audit firms, members of the board are usually Certified Public Accountants. However, at Mazars in Denmark, not all board members are CPAs, which contributes to background diversity. What do you think about this?

Mazars is more than an audit firm, because we are enriched by offering many different service lines. Therefore, having this diversity in the board is important to both avoid decision-making processes that could be one-sided and be able to influence all service lines. We need to consider the organisation as a whole.

At Mazars in Denmark we are lucky that board members are totally different but create synergies and bring their backgrounds and perspectives to the table to add up to the company.